Driving Customer Retention, Development, and Profit

For traditional Financial Services Institutions (FSI’s), it is becoming increasingly difficult to capture competitors especially since competitors are becoming larger, and more non-FSI’s are offering financial services and products. A steady flow of new, innovative services and delivery channels is usually necessary to build market share. Of course, these can be costly to develop and execute.

However, with a greater customer focus, greater emphasis on relationship marketing (the leaky bucket concept) and effective customer retention plans, you may discover greater profitability within your existing customer base.

In the past, it was always easier to attempt to “poach” your competitors’ customers. However, studies have shown that companies spend five times more money on acquiring new customers as they do on retaining those they already have. Further studies demonstrated that: “As a customer relationship with a company lengthens, profits rise.” And not just a little. Companies can boost profits by 100% by retaining just 5% more of their customers. This does not necessarily specifically apply to banking, but Pareto’s Law still applies. One Bank found that the top 20% of its customers made all the profit, while the other 80% cost it money. The question is, have you considered the lifetime value of each of your customers? And, who makes up the 20% or less that accounts for the majority of your current and potential future profits?

The key to marketing success is the ability to ask the right questions that relate to a well thought out and actionable strategy. These are usually fundamental questions, and should be answerable with available data. Unfortunately, finding that data turning into information and getting the answers you need is typically impossible with the way information systems are structured.

A customer knowledge infrastructure with a data warehouse at it’s heart provides an opportunity to ask those difficult questions with a good chance that most of them will be answered. For example, with better information about just who are the FSI’s customers, you are better able to serve and keep them.

A bank in the United Kingdom attempted to find just how many customers it had. They derived a number from a range of disparate computer systems that provided different bank services. That number was twenty-five million. When they finally cleaned up the data and used matching software to eliminate duplicates and triplicates, they actually found they had seven million distinct customers. There were customers in different databases that were not stored by name but by account number. In addition, incomplete records existed in many systems that focused on products. To make specific offers to your customer base’ you have to know who they are. Without a clear picture of who your own customers are, it is just as easy to pursue your competitors customers.

Rudimentary Segmentation

To be able to do even rudimentary segmentation, you need to know at least your customers’ names, addresses, ages, sex, etc. Yet, traditional marketing segmentation methods — demographics, psychogaphics, geodemographics, behavioral, and clusters — are just coming into play in some financial institutions and they are not enough.

In many cases, the data does not reflect household-by-household information. Profiles taken of particular types of households don t represent the individuals and their likely propensities to act in particular ways.

A reliable predictor of future behaviour in humans is their actual past behaviour, which is why transactional information is key. The future success of your financial institution depends on knowing as much as you can about each individual customer, rather than what you know about all of your customers. A culture must be fostered that continuously gathers customer specific information that enhances your customer information database. Every encounter must be seen as another opportunity to find out additive information. This information forms the basis of a FSI’s real assets; its relationships with its customers.

Few banks have this depth of information to mine. And even if they did, there was little they could do with it. The sheer amount of data they had could not be turned into answers because of duplications of inaccurate information, the lack of focused base data, and the weakness of current technology.

At last a Customer Focus

To overcome this, some banks now use customer knowledge infrastructures that include data warehouses/data marts with a customer focus that sets them apart from their traditional operational databases. Operational and often organisationally disparate databases, by the very nature of their data structures, predicate against easy customer focused analysis. The data warehouse has become the basis upon which specific business aims can be achieved and predictive models can be built. They do not just store data.

Today, large successful banks have been able to consolidate names and addresses using matching software to clean their data. With this “one version of the truth” they are now able to identify customers as individuals.

How long has that customer been with the bank? Are there any other accounts in the same family? Are they a one, two or many product family? The questions keep coming. The difference is that the answers are at hand. Through data mining, predictive models can be built for database marketing, as opposed to decision support.

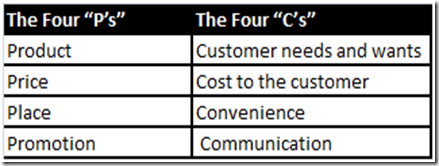

When you can see who the customers actually are and what they do with the institution, then there is an opportunity to more effectively market to them. This approach has even changed the traditional description of marketing – “The Four P’s” – to demonstrate a move towards a greater customer focus – “The Four C’s”

The move to a greater customer focus is an attempt to see things from a customer perspective. Always keep in mind that the purpose of marketing is to generate customer-perceived value, profitably When looking at retention programs, you must appreciate who you want to retain and why. What would you plan for the marginal customer and those on which you make a loss? Customer retention planning is where the solution begins, and its implementation is where you add to bottom line profitability Loyal customers are typically more profitable customers. There are no acquisition costs. They tend to buy more services and try out new ones. Their growing number becomes an annuity. You can manage the costs of servicing their needs. And, they act as word-of-mouth marketers for you.

Customer Retention Management

Customer retention management is achieved by building a deep insight into who your customers are, then developing and using models that will predict which customers are likely to defect. By using these models, along with profitability potential models, you are able to make informed decisions about which customers to attempt to retain. You could also look at their individual profit improvement potential and make decisions about how you can meet their needs.

Experience has shown that banks with a focus in this area have achieved significant improvement in retention levels, retaining up to 35% of the customers who would ordinarily have defected.

The key is to identify the changes of the customers behaviour that could indicate a potential defection – change of address, regular credit lines cancelled, complaints made, account balances decline – and then to take some action in order to prevent the potential attrition.

However, key to the profitable success of this action is to be able to assess which customers are worth retaining, from a current or potential profitability standpoint. There is a theory that customers decide to defect many months before they actually leave, so it is important to recognise their behaviours and their profitability potential at the point of their decision, not necessarily at the point of attrition.

Promotion Communication

There is also strong evidence that retention increases in direct proportion with the number of products held by a customer.

Other evidence shows that nearly 75% of all defectors held only one product for a full year before leaving. It is partly for this reason that many banks have introduced “loyalty” programs, where customers gain value through discounts on the bank’s products. These programs are intended to strengthen the relationship by making it broader, either through more products being acquired or through greater expenditure on a revolving credit facility.

To be successful in this arena, it is essential to understand which customers are to be targeted and to measure their reaction to the offer. Using your marketing budget to solicit unprofitable or marginal customers is simply not good business. By leveraging information assets, banks can become attuned to customers’ needs, which translates into more responsive services, which leads to improved customer satisfaction.

By better understanding the customer, a bank is able to more effectively target the right promotion, to the right prospects, at the right time through the right channels. By using combinations of internally created information, web gathered and outside sourced information, the cost of customer acquisition can be reduced by the use of more effective customer knowledge. FSI’s that have adopted customer knowledge infrastructure as a support tool in their approach to marketing have been able to grow their businesses and increase income, while reducing costs. The tangible benefits can be clearly measured, as can the spin-off benefits relating to enhanced customer service and staff morale.

The typical results of customer knowledge-based marketing activity show a 200% to 400% improvement in converted response rates. The actual results vary by product, but as a “rule of-thumb” expect the rate of response before this approach to be multiplied by a factor of 2 to 4 times.

Some can do it

A UK bank developed a complete array of models that offered the capability to predict each customer’s propensity to buy each product in the consumer range. The bank was able to pre-score all customers for each of four lines of credit – overdraft, credit card, unsecured loan and debit card. They considered recent behavioural patterns, cross-sell propensity models and also considered pre-approving applications. This combined approach to marketing and risk management enabled the bank to start thinking about a new way of planning to get a greater customer wallet share, and to deliver a more focused way of achieving its revenue targets.

On the planning side, the models could be used to predict the mix of products that could be sold over the early part of the plan – say the first year of a three-year forecast. This same exercise helps the bank identify gaps in its product range, as well as customers with little potential. A more intelligent set of targets can then be built into the plan for sales and marketing.

On the target marketing side, the more timely and relevant the contact, the more likely customers will respond and buy a “new” or “improved” product or service.

Two specific campaigns can be cited as examples of the successes for one bank. The typical response rate to its campaigns designed to attract checking account holders to take out a personal loan had been 1%. This usually cost justified the campaign. Following their switch to focused database marketing, the campaign generated a 3% to 4% converted response.

Similarly, when making guaranteed offers of a debit card, the bank was able to generate responses between 20% and 25%, compared to previous bests of around 8%. Given the increasing success of these database approaches in creating better quality and higher response rates, this bank expects to spend more on direct marketing than on above the line television advertising.

The Journey

To get from where you are now to where you could be, is not a trivial undertaking. It is however, a step you will have to make to remain competitive. You have the customer data. All you need to do is manage its transformation into marketing information.

Unfortunately, an effective CRM implementation supported b a data warehouse based customer knowledge infrastructure is not an off-the-shelf solution. You need to clearly define the business problems you hope to solve, the strategic imperatives you want to satisfy and then work with consultants and vendor s that can provide the technology infrastructure, the services and the experience that is so critical to success.

Furthermore, building a customer knowledge infrastructure just like implementing CRM is not a destination, but rather a journey. It requires a long-term commitment to be truly effective. The process is not a project but a major programme that includes some technologies and lots of change management. But once you have started the journey, you will find a wealth of information that will help you drive customer retention and profitability.

– Shailendra Kumar