Many banks believe they can improve profits through information-based continuous relationship marketing (CRM). A better understanding of customer needs can help them acquire new customers, sell more products to those customers, and prevent other customers from taking their business elsewhere. In two years, one large North American bank trebled the number of products it sold per client household by using needs-based profiling; another pursuing the same approach saw a 60 percent increase. Yet others have acquired new customers for loan and investment products who hold transaction accounts elsewhere. And, intelligently used, database marketing has reduced mailing sizes for direct mail campaigns by as much as two-thirds.

But this type of marketing approach has to be developed carefully. Many of the fast-growing and profitable US financial companies that have stolen business from traditional multiproduct banks are expert at it. To build the same skills, many banks are spending tens of millions of dollars on databases and marketing techniques – with no guarantee of success.

The fact is that CRM cannot simply be grafted onto the multiproduct, multichannel organization of most banks. The huge amount of information available to these banks, coupled with the wide array of products and services they sell, can make implementing CRM a complicated and time-consuming task entailing broad institutional change.

The marketing formula, related business processes, and supporting technology may all have to be redesigned. In particular, customer acquisition and management processes will have to be adapted and channels coordinated. Aware of this challenge, many bankers embark on high stakes reforms. They invest heavily in large databases to market all or many of their products to all their customers; in state-of-the-art statistical models to analyze new data and products; and in organizational structures designed around customers rather than products. But they risk biting off more than they can chew. Although the goals are laudable, those who try to achieve too much, too fast, are likely to find the payoff elusive at best.

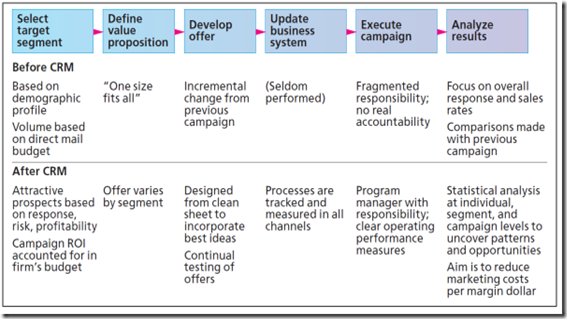

Refining elements of the marketing campaign

In my experience, banks that have taken a more modest, gradual approach – building competitive advantage in certain geographic regions or product segment by product segment, and learning by trial and error – have made considerable gains. Those tempted to go for the “big bang” have to re-examine the rationale behind their strategy.

There are five myths likely to be uncovered:

Myth 1: Excellent CRM capabilities constitute a successful strategy

Many banks are tempted to spend time and effort building CRM capabilities in the belief that these alone will deliver success. But without a clear, compelling value proposition, the power of marketing is limited. What, for example, is the point of building a marketing database or developing attractive promotional and enrollment materials if the product is a high-load, unbranded mutual fund that no one wants?

Instead, banks must develop value propositions that give them an edge over product-focused rivals. They can then use CRM tools to extract maximum value from their competitive advantage. An emphasis on relationships can indeed become part of their strategy, but first they must make sure that enough customers value the proposition sufficiently to make it profitable, and that they can deliver on that promise.

Once a powerful set of value propositions has been defined, a CRM approach can be used to identify which offers are likely to be most attractive to which people. Using databases to test and refine offers can be an element of a strategy, but it is not a strategy in itself.

Myth 2: To capture value from CRM, a bank must organize around customer segments rather than products

CRM’s focus on the lifetime value of a customer and the ability to segment actual and prospective customers by needs, behaviour, propensity to buy, and other characteristics lead, not unreasonably, to the assumption that a bank should be organized around customer segments. Yet reorganizing a

multiproduct (and usually business-unit-oriented) institution around customer segments, at the same time as building data-driven marketing and customer management capabilities, creates extraordinary complexities for systems, processes, and people. As a result, the payoff is likely to be slow.

Moreover, almost all the winners in the US Financial services market are focused on products or product segments. Although the nature of competition varies from market to market, it is true to say that most bankers business is now threatened on a product-by-product basis. The most successful banks respond by viewing their product groups as individual businesses each with their own competitors, and accordingly build and apply CRM capabilities unit by unit.

Although banks do not have to organize around customer segments, they do have to consider how their CRM capabilities will be integrated within their organization. Too much attention paid to building a narrow set of CRM skills, without enough thought as to the impact CRM can have on the rest of the organization and on how the integration will be managed, is wasted effort.

The links between CRM and channel strategy are particularly important. Ideally, marketing efforts should be coordinated across channels so that a customer does not receive different offers from different parts of the bank.

Without this coordination, a customer might receive a direct mail shot offering to renew a mortgage at a 0.5 percent discount, for example, then be offered a cheaper (or more expensive) deal by a branch or via a telephone channel.

Myth 3: Successful CRM means building a large, integrated database with complete customer profiles, behavioural data, and profitability measures

A comprehensive, centrally managed database that enables a bank to build the closest possible relationship with customers across all products and services may be the endgame of CRM. It is not a prerequisite.

With a few exceptions, successful financial services companies have approached CRM product by product, keeping their focus narrow and selling via inexpensive direct delivery channels. This approach offers banks two advantages: First, it simplifies system design and maintenance; second, it simplifies customer ownership issues. Moreover, the falling cost of storing, processing, and gaining access to customer data makes it economic for individual business units to develop their own systems.

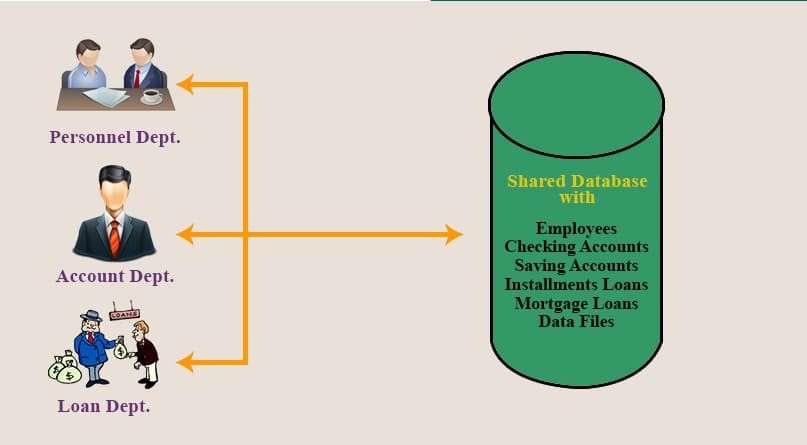

Ultimately, most banks will have to explore cross-product opportunities in order to differentiate themselves from product specialists. There are two primary design requirements to ensure that all the pieces come together at this stage: common standards for core systems (for database structure, for example) so that separate systems can be linked, and a central databank (with clean customer address files and third-party data) that is accessible to all.

This is not to say that companies should never try to build a cross-product database from the outset. If data needs to be cleaned up across many products, a single project may focus efforts and eliminate duplication. Similarly, a single project may prove more effective where substantial additional data is required and capturing it would mean redesigning a number of existing single-product systems.

In either case, building a database should not be allowed to hold up progress. Organizations that learn quickly resist the urge to try to harness more data than they can effectively analyze; they ask “How could this information be used to raise profits” before they add yet another field to the database. Without this discipline, there is a risk that some of the most valuable information may be overlooked in what becomes a directionless quest for more and more data.

Myth 4: The most sophisticated analytical techniques are needed to mine historical data

Some banks have been seduced by the most elaborate (and expensive) analytical techniques, which they hope will fix poor products, service, or pricing. But the best database marketers know that these techniques often have only limited incremental value. Although success does depend on obtaining the right data, then developing meaningful variables, simpler tools exist that deliver more comprehensible and relevant insights. Important though it is to analyze historical data, too many firms overrate it. Data is frequently incomplete, inaccurate, and outdated, and “garbage in invariably means garbage out”.

I therefore make two recommendations:

- Be forward looking. Banks should avoid spending too much time and resources on analyzing why old offers failed. They should understand the main lessons that can be drawn from the information available, then create and test new approaches, rather than trying to make incremental improvements to existing ones.

- Be hypothesis driven. Bank executives should decide what they expect to find, then conduct analysis to confirm and/or deny the hypothesis, rather than reviewing reams of data first in the hope of drawing some conclusions from it. What banks must review, however, is how well they manage individual customers and segments. Most institutions do not think of acquiring customers as a business process. As a result, prospects slip through their fingers. Banks should integrate all data on prospects, leads, and conversion of contacts in order to establish a closed-loop system that tracks every lead and provides a basis for evaluating the effectiveness of specific channels, and even of individual salespeople.

Here again, it is important not to get mired in reports. The priority is to select a few key performance measures that are clearly linked to program goals and objectives, such as acquisition, cross-selling, and retention. These are business processes that can be measured to get a handle on the nuts-and-bolts economics (the cost of acquiring a customer and his or her expected lifetime value), and that can also be managed.

Myth 5: Everything needs to be in place – database, infrastructure, and processes – before CRM can begin to work

An iterative approach that tests offers, technology, and business processes can be cheaper and more effective than one that waits until all the components are exactly right – partly because lessons can be learned from mistakes. Institutions that strive for early perfection not only take a long time to get a project off the ground, but will probably fall short of the mark without necessarily knowing why.

A “try it, fix it” approach to system and business process development means a core system can be up and running quickly; offers, processes, and models can be tested with minimal investment; and design can be improved as a bank goes along. Marketing programs can be tried out before systems are completed, and monitored by rudimentary tracking systems. What the bank learns about data quality and report needs and the success of the campaign itself will guide the eventual overall design.

Failures are a token of the “test, learn, test” process.

The aim is to test and learn on a scale where the value of learning outweighs the cost of occasionally disappointing results. It is from such failures that many effective marketers have built their capabilities and learned how to sustain competitive advantage.

Most leaders in traditional banks understand that CRM threatens their core customer franchise. Many also recognize that, if they build the right skills, they can use it to their own advantage. So the main question for them is not whether to adopt this digital weaponry, but how. CRM calls for fundamental changes in the way sales, customers, and channels are managed. My advice to these executives is to pick their shots carefully. They are more likely to earn attractive returns if they start small, learn what works, and then grow big.

Shailendra